UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrantx¨

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to |

H.B. FULLER COMPANYFuller Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Office: | 1200 Willow Lake Boulevard | |

| St. Paul, Minnesota 55110-5101 | ||

Mail: | P.O. Box 64683 | |

| St. Paul, Minnesota 55164-0683 | ||

Phone: | (651) 236-5158 |

Dear Shareholder:

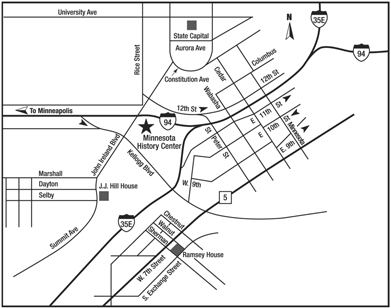

Our 20062007 Annual Meeting of Shareholders will be held on Thursday, April 6, 2006,5, 2007, at the Science Museum of Minnesota, History Center, 345120 West Kellogg Boulevard, West, Saint Paul, Minnesota. The meeting will begin promptly at 2:00 p.m. Please join us. Parking at the History CenterScience Museum of Minnesota for attendance at the Annual Meeting is complimentary. Parking vouchers will be available in the lobby of the History Center.Science Museum.

The Notice of Annual Meeting of Shareholders and the Proxy Statement that follow describe the business to be conducted at the meeting. Also enclosed is a copy of our 20052006 Annual Report, including our Annual Report on Form 10-K. We hope you find these materials informative and useful. You can also view these materials on the Internet atwww.hbfuller.com. in the Investor Relations section.

Your vote is important, so please sign and return the enclosed proxy card in the postage-paid envelope or instruct us by telephone or via the Internet as to how you would like to vote your shares.

| Sincerely, | ||

| ||

| ||

| ||

Chief Executive Officer |

March | PROXY STATEMENT |

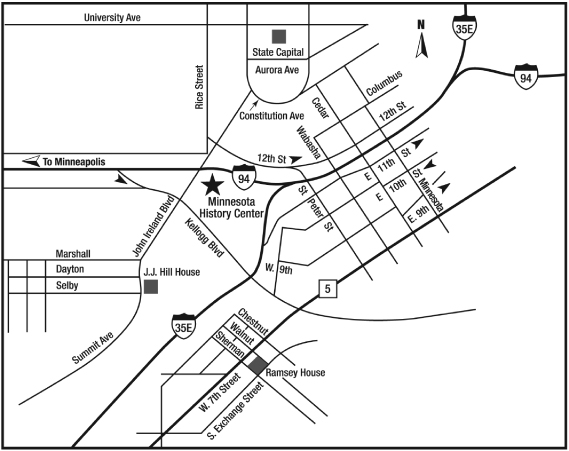

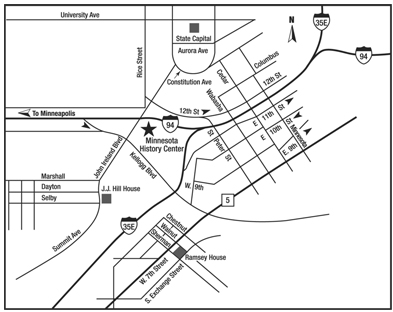

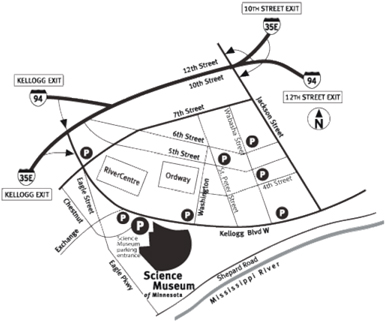

DIRECTIONS TO THE SCIENCE MUSEUM OF MINNESOTA HISTORY CENTER

345120 WEST Kellogg Boulevard West

St. Paul, Minnesota

651-296-6126 or651-221-9444-or

1-800-657-37731-800-221-9444

Directions:

From the north:Eastbound on I-94 or Northbound on I-35E: Take I-35E south to St. Paul. Follow signs to I-94 west and take the Marion Street exit. Go left on Marion, crossing over I-94, and follow signs to Kellogg Blvd. The History Center is straight ahead. After traffic lights atexit. Follow Kellogg to the three-way intersection of John IrelandKellogg, West 7th Street, and Kellogg, get intoEagle Street. Turn right down Eagle Street. At the left-turn lane. This takes yousecond stoplight, Chestnut Street, turn left. Proceed to the parking lot.lower ramp entrance.

FromWestbound on I-94: Take the south: Take I-35E north12th Street exit and exit at Kellogg Boulevard.follow to Jackson Street. Turn left onand go south to Kellogg Blvd. Turn right onto Kellogg, and continue six blocks. The museum will be on your left. Be sure you are in the left lane and follow the exchange Street underpass, which ducks underneath Kellogg Blvd. Continue down Exchange to the first intersection and take a left on Eagle. Then take the first right intonext left on Chestnut and proceed to the lower parking lot.entrance.

From the east:Southbound on I-35E: Take I-94 west. Exit at Marionthe 10th Street exit to Jackson Street, turn left and go south to Kellogg Blvd. Turn right onto Kellogg, and continue six blocks. The museum will be on your left. Be sure you are in the left lane, and follow the Exchange Street underpass, which ducks underneath Kellogg Blvd. Follow Exchange to the first intersection and take a left on Marion, crossing over I-94. FollowEagle. Then take the signs for Kellogg Boulevard. After the intersection of Kelloggnext left on Chestnut and John Ireland boulevards, get into the left-turn lane. This takes youproceed to the lower parking lot.

From the west: Take I-94 east to the Marion Street/Kellogg Boulevard exit. Follow the signs for Kellogg. After the intersection of Kellogg and John Ireland boulevards, get into the left-turn lane. This takes you to the parking lot.entrance.

By public transportation: The Science Museum of Minnesota History Center is served by buses from Minneapolis, St. Paul Bloomington and surrounding suburbs. For bus schedules, call Metro Transit at 612-373-3333.

PARKING: Parking is available in the parking lot adjacent toof the History Center.Science Museum of Minnesota.

Office: | 1200 Willow Lake Boulevard | |

| St. Paul, Minnesota 55110-5101 | ||

Mail: | P.O. Box 64683 | |

| St. Paul, Minnesota 55164-0683 | ||

Phone: | (651) 236-5158 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Date and Time: | Thursday, April | |

Place: | Science Museum of Minnesota | |

| St. Paul, Minnesota | ||

Items of Business: | The election of three directors for a three-year term. | |

| The | ||

| Any other business that may properly be considered at the meeting or any adjournment thereof. | ||

Record Date: | You may vote at the meeting if you were a shareholder of record at the close of business on February | |

Voting by Proxy: | Whether or not you plan to attend the meeting in person, please mark, date and sign the enclosed proxy card and mail it in the enclosed envelope. No postage is required if the proxy card is mailed in the United States. Instead of mailing the proxy card, you may enter voting instructions by telephone at 1-800-560-1965 or via the Internet atwww.eproxy.com/ful/. | |

Annual Report: | H.B. Fuller’s | |

By Order of the Board of Directors | ||

| ||

Timothy J. Keenan | ||

Vice President, General Counsel and Corporate Secretary | ||

March 6, 20062, 2007

ANNUAL MEETING OF SHAREHOLDERS

APRIL 6, 20065, 2007

The Board of Directors of H.B. Fuller Company is soliciting proxies to be used at the Annual Meeting of Shareholders to be held on April 6, 2006,5, 2007, and at any adjournment and reconvening of the meeting. We began mailing this Proxy Statement and the enclosed form of proxy on March 6, 2006.2, 2007.

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

What is the purpose of the meeting?

At our annual meeting, Shareholders will act upon the matters disclosed in the Notice of Annual Meeting that preceded this Proxy Statement. These include the election of three directors approval of the Amended and Restated Year 2000 Stock Incentive Plan and ratification of the appointment of our independent auditors.

We will also consider any other business that may properly be presented at the meeting, and management will report on H.B. Fuller’s performance during the last fiscal year and respond to questions from Shareholders.

How does the Board recommend that I vote?

The Board of Directors recommends a vote for all of the nominees for director for approval of the Amended and Restated Year 2000 Stock Incentive Plan and for the ratification of the appointment of KPMG LLP as the Company’s independent auditors for the fiscal year ending December 2, 2006.1, 2007.

Who is entitled to vote at the meeting?

If you were ashareholder of record at the close of business on February 17, 2006,16, 2007, you are entitled to vote at the meeting.

As of the record date, 29,390,99060,683,368 shares of Common Stock were outstanding and eligible to vote.

What is the difference between a shareholder of record and a street name holder?

If your shares are registered directly in your name, you are considered theshareholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, such as the H.B. Fuller 401(k) Thrift Plan, you are considered the beneficial owner of those shares, and your shares are held instreet name. If you are astreet name holder, you will receive a “voting instructions” card, which appears very similar to a proxy card. Please complete that card as directed in order to ensure your shares are voted at the meeting.

What are the voting rights of the Shareholders?

Holders of Common Stock are entitled to one vote per share. Therefore, a total of 29,390,99060,683,368 votes are entitled to be cast at the meeting. There is no cumulative voting for the election of directors.

How many shares must be present to hold the meeting?

A quorum is necessary to hold the meeting and conduct business. The presence of Shareholders who can direct the voting of at least a majority of the outstanding shares of Common Stock as of the record date is considered a quorum. A Shareholder is counted as present at the meeting if the Shareholder is present and votes in person at the meeting or the Shareholder has properly submitted a proxy by mail, telephone or via the Internet.

If you are ashareholder of record, you can give a proxy to be voted at the meeting either:

over the telephone by calling 1-800-560-1965;

| • | electronically, using the Internet atwww.eproxy.com/ful/; or |

by mailing in the enclosed proxy card.

The telephone and Internet voting procedures have been set up for your convenience. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly. If you are ashareholder of record and you would like to vote by telephone or by using the Internet, please refer to the specific instructions on the enclosed proxy card. If you wish to vote using the paper proxy card, please return your signed proxy card to us before the meeting. You may also vote in person at the meeting.

If you hold your shares instreet name, you must vote your shares following the procedures indicated to you by your broker or nominee on the enclosed voting instructions card.

What does it mean if I receive more than one proxy card or voting instructions card?

It means you hold shares of H.B. Fuller stock in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you vote by telephone or via the Internet, vote once for each proxy card you receive. If you would like to consolidate your accounts please contact our stock transfer agent, Wells Fargo Bank,Shareowner Services, at 1-800-468-9716.1-800-468-9716 or via mail at: Shareowner Services, P.O. Box 64874, St. Paul, Minnesota 55164-0874 or via courier at: Shareowner Services, 161 North Concord Exchange, South St. Paul, MN 55075.

Can I vote my shares in person at the meeting?

Yes. If you are ashareholder of record, you may vote your shares at the meeting by completing a ballot at the meeting. However, even if you currently plan to attend the meeting, we recommend that you submit your proxy ahead of time so that your vote will be counted if, for whatever reason, you later decide to not attend the meeting.

If you hold your shares instreet name, you may vote your shares in person at the meeting only if you obtain a signed proxy from your broker, bank or other nominee giving you the right to vote such shares at the meeting.

What vote is required for the proposals to be approved?

With respect to the election of directors, the three director nominees receiving the most votes for their election will be elected directors. With respect to approval of all other matters to come before the meeting, including the approval of the Amended and Restated Year 2000 Stock Incentive Plan and the ratification of the appointment of KPMG LLP as the independent auditors of the Company, the affirmative vote of a majority of the shares of Common Stock represented and entitled to vote on each matter is required.

Shareholders may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the Board of Directors. Shareholders may vote “FOR,” “AGAINST” or “ABSTAIN” on the approval of the Amended and Restated Year 2000 Stock Incentive Plan and the ratification of the appointment of KPMG LLP.

If you vote ABSTAIN or WITHHOLD, your shares will be counted as present at the meeting for the purposes of determining a quorum. If you ABSTAIN from voting on a proposal, your abstention has the same effect as a vote against that proposal. If you WITHHOLD authority to vote for one or more of the nominees for director, this will have no effect on the election of any director from whom votes are withheld.

If you hold your shares instreet name and do not provide voting instructions to your broker or nominee, your shares may not be voted. In this situation, a “broker non-vote” may occur. Shares that constitute broker non-votes will be present at the meeting for the purpose of determining a quorum, but are not considered as entitled to vote on the proposal in question, and, therefore, will not affect the outcome of the vote with respect to that proposal.

What if I do not specify how I want my shares voted?

If you do not specify on your returned proxy card (or when giving your proxy by telephone or via the Internet) how you want to vote your shares, we will vote them:

FOR all of the nominees for director;

with respect to such other matters that may properly come before the meeting, in accordance with the judgment of the persons named as proxies in the enclosed proxy card or voting instructions card.

Yes. If you are ashareholder of record, you may change your vote and revoke your proxy at any time before it is voted at the meeting in any of the following ways:

by sending a written notice of revocation to the Corporate Secretary of the Company;

by submitting another properly signed proxy card at a later date to the Corporate Secretary;

by submitting another proxy by telephone or via the Internet at a later date; or

by voting in person at the meeting.

If you are astreet name holder, please consult your broker, trustee or nominee for instructions on how to change your vote.

Who pays for the cost of proxy preparation and solicitation?

We pay for the cost of proxy preparation and solicitation, including the charges and expenses of brokerage firms or other nominees for forwarding proxy materials to beneficial owners of shares held instreet name. We have retained Morrow & Company, Inc. to assist in the solicitation of proxies for a fee of approximately $5,500.00 plus associated costs and expenses.

We are soliciting proxies primarily by mail. In addition, proxies may be solicited by telephone or facsimile, or personally by directors, officers and regular employees of the Company. These individuals will receive no compensation (other than their regular salaries) for these services.

OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows how much H.B. Fuller Common Stock each director and executive officer listed in the Summary Compensation Table in this Proxy Statement beneficially owned as of January 31, 20062007 (unless otherwise noted). The table also shows the beneficial ownership of H.B. Fuller Common Stock by all directors and executive officers of H.B. Fuller as a group. In addition, the table shows all shareholders known to us to be the beneficial owners of more than 5% of H.B. Fuller Common Stock. Shareholders of record as of July 28, 2006 received one share of H.B. Fuller Common Stock for each share of Common Stock held as of this record date. All holdings in the following table have been adjusted for this two for one stock split.

In addition to the shares listed in this table, certain executive officers and directors hold phantom stock units under the Company’s deferred compensation plans that will be paid out in shares of H.B. Fuller Common Stock. These units are subject to the same economic risk as a direct investment in H.B. Fuller Common Stock. As of January 31, 2006,2007, in addition to the amounts shown below, the executive officers and directors, as a group, held phantom stock units representing 126,393265,570 shares of H.B. Fuller Common Stock.

Unless otherwise noted, the Shareholders listed in the table have sole voting and investment powers with respect to the shares of Common Stock owned by them.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of

Outstanding | ||||

Mairs and Power, Inc. | (1) | % | ||||

| (2) | % | ||||

Knut Kleedehn | (3) | * | ||||

J. Michael Losh | (3) | * | ||||

Richard L. Marcantonio | (3)(4) | * | ||||

Lee R. Mitau | (3)(4) | * | ||||

Alfredo L. Rovira | (3) | * | ||||

John C. van Roden, Jr. | (3)(4) | * | ||||

R. William Van Sant | (3) | * | ||||

Albert P.L. Stroucken | (5) | % | ||||

John A. Feenan | (6) | * | ||||

Michele Volpi | 90,683 | (7) | * | |||

Edwin J. Snyder | 67,410 | (8) | * | |||

Stephen J. Large | ||||||

| ||||||

| (9) | * | ||||

All directors and executive officers as a group | (10) | % |

| * | Indicates less than 1%. |

| (1) | As of December 31, |

| (2) | As of December 31, |

Investors, Ltd. The holder reported that |

Knut Kleedehn | 1,376 | Alfredo L. Rovira | 1,371 | |||

J. Michael Losh | 1,376 | John C. van Roden, Jr. | 1,345 | |||

Richard L. Marcantonio | 1,322 | R. William Van Sant | 1,368 | |||

Lee R. Mitau | 9,171 |

| Excludes Common Stock units credited to the accounts of directors who participate in the Directors’ Deferred Compensation Plan, described under the heading “How are directors compensated?” These Common Stock units are not entitled to vote at the meeting. The number of units credited to each director participating in this plan is as follows: |

Knut Kleedehn | 7,493 | Alfredo L. Rovira | 4,665 | 12,826 | Alfredo L. Rovira | 11,339 | ||||||

J. Michael Losh | 14,584 | John C. van Roden, Jr. | 1,355 | 34,517 | John C. van Roden, Jr. | 1,902 | ||||||

Richard L. Marcantonio | 3,625 | R. William Van Sant | 10,916 | 11,837 | R. William Van Sant | 26,692 | ||||||

Lee R. Mitau | 23,753 | 52,717 |

| (4) | Includes the following shares of Common Stock awarded under the 1998 Directors’ Stock Incentive Plan, including shares acquired upon reinvestment of dividends: |

Richard L. Marcantonio | 2,673 | John C. van Roden, Jr. | 2,719 | |||

Lee R. Mitau | 15,753 |

| (5) | Mr. Stroucken’s holdings shown are as of December 1, 2006, the date of Mr. Stroucken’s resignation from the Company. Includes |

| (6) | Includes |

| (7) | Includes |

| (8) | Includes 22,289 shares of restricted Common Stock subject to forfeiture, 42 shares held in trust under H.B. Fuller’s 401(k) Thrift Plan and 45,079 shares that could be issued pursuant to stock options which are currently exercisable. |

| (9) | Includes 39,288 shares of restricted Common Stock subject to forfeiture and 3,537 shares held in trust under H.B. Fuller’s 401(k) Thrift Plan. Excludes 1,862 restricted stock units which are subject to forfeiture and |

| Includes |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During our 20052006 fiscal year, U.S. Bank National Association (“U.S. Bank”) was one of a syndicate of participating lenders under H.B. Fuller’s unsecured revolving and term credit facilities. Under these credit facilities during fiscal 2006, we paid U.S. Bank National Association approximately $354,976, plus interest payments on outstanding debt owed,in the amount of $690,787 and upfront and non-usage fees of $38,088. We also paid U.S. Bank for certain credit, trustee and creditthe following services during fiscal 2006:

Credit card services providedrelated to usour employee travel and our subsidiaries duringexpense reimbursement program for which we paid $9,240 in fees and received $100,733 in rebates.

Trustee services related to pension and welfare benefit plans for which the 2005 fiscal year. trustees of such plans paid U.S. Bank $100,566 in fees.

Lee R. Mitau, a directornon-executive Chairman of the Company,Board of Directors of H.B. Fuller, is the Executive Vice President and General Counsel of U.S. Bancorp, the ultimate parent company of U.S. Bank. We believe that thesethe U.S. Bank services were provided under terms no less favorable to us than are available to other customers of U.S. Bank. We expect to continue to acquire such services from U.S. Bank during the 20062007 fiscal year.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers to file initial reports of ownership and reports of changes in ownership of H.B. Fuller’s securities with the Securities and Exchange Commission (SEC). These reports are available for review on the Investor Relations section of our website:www.hbfuller.com/Investor Relations/SEC Filingswww.hbfuller.com. Directors and executive officers are required to furnish us with copies of these reports. Based solely on a review of these reports and written representations from the directors and executive officers, we believe that all directors and executive officers complied with all Section 16(a) filing requirements for fiscal year 2005,2006, except for Albert P.L. Stroucken, Chairman of the Board, PresidentJohn C. van Roden, Jr., director, and Chief Executive Officer, and Knut Kleedehn,Alfredo Rovira, director, who each filed one late report in connection with the vestingCompany’s annual grant of restricted shares ofCommon Stock units to all the Company’s Common Stock.directors.

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors is currently composed of eight directors and divided into three classes. Each year one class of directors stands for election for a three-year term. The term of office for Class III directors, consisting of Richard L. Marcantonio, Alfredo L. RoviraKnut Kleedehn, John C. van Roden, Jr. and Albert P.L. Stroucken,Michele Volpi, will expire at the Annual Meeting.

At the Annual Meeting, three persons are to be elected as Class III directors to hold a three-year term of office from the date of their election until the 20092010 Annual Meeting and until their successors are duly elected and qualified. The three nominees for election as Class III directors are Richard L. Marcantonio, Alfredo L. RoviraKnut Kleedehn, John C. van Roden, Jr. and Albert P.L. Stroucken,Michele Volpi, all of whom are currently directors. All of the nominees have agreed to serve as a director if elected. FollowingOn January 26, 2007, the meeting,Board of Directors appointed Juliana L. Chugg as a director of the Company effective April 4, 2007. Ms. Chugg will be a Class I director. Therefore, following the Annual Meeting, the Board will be composedcomprised of eightnine directors. Pursuant to the Company’s Bylaws, no more than 15 persons may serve on the Board. For information on how a Shareholder may suggest a person to be a nominee to the Board, see“How can a Shareholder suggest a candidate for election to the Board?”

The term of office for Class III directors, currently consisting of Knut KleedehnRichard L. Marcantonio and John C. van Roden, Jr.,Alfredo Rovira, and including Juliana L. Chugg effective on April 4, 2007, will expire at the Annual Meeting in 20072009 and the termsterm of office for Class III directors, consisting of J. Michael Losh, Lee R. Mitau and RobertR. William Van Sant, will expire at the Annual Meeting in 2008. Mr. MarcantonioVolpi was elected by the Board of Directors on September 29, 2004.effective December 3, 2006, and, as discussed above, Juliana L. Chugg was elected by the Board of Directors effective April 4, 2007. All of the other directors were elected to the Board of Directors by the Shareholders.

We will vote your shares as you specify when providing your proxy. You may either vote FOR or WITHHOLD authority to vote for each nominee for the Board of Directors. If you submit your proxy

without voting instructions, we will vote your shares FOR the election of the three nominees. If, for any reason, any nominee becomes unable to serve before the election, we will vote your shares for a substitute nominee selected by the Board of Directors. Alternatively, the Board of Directors, at its option, may reduce the number of directors constituting Class III directors.

The three director nominees receiving the most votes for their election will be elected directors.

The Board of Directors recommends a vote FOR election of each of the nominees.

The nominees provided the following information about themselves as of January 31, 2007.

| Knut Kleedehn | ||

| Age: | 69 | |

| Director Since: | 2001 | |

| Principal Occupation: | Private Investor | |

| Business Experience: | Mr. Kleedehn was with Bayer AG from 1960 to 2001. At Bayer, he served in a series of senior management roles as President and Senior Country Representative of Bayer for Japan and Korea, co-chair of Bayer do Brasil, General Manager of Bayer’s Pigments and Ceramics Division, and CEO of three Bayer chemical divisions and several subsidiaries. | |

| John C. van Roden, Jr. | ||

| Age: | 57 | |

| Director Since: | 2003 | |

| Principal Occupation: | Consultant to Glatfelter, Inc., a specialty paper producer located in York, Pennsylvania. | |

| Business Experience: | Mr. van Roden was appointed Executive Vice President and Chief Financial Officer of Glatfelter, Inc. in February 2005 and served in that capacity until January 2007, at which time he became a consultant. From 2003 to February 2005 he served as Senior Vice President and Chief Financial Officer of Glatfelter, Inc. He served as Senior Vice President and Chief Financial Officer for Conectiv, an energy company located in Wilmington, Delaware, from 1998 to 2003 and at Lukens, Inc., a specialty steel producer located in Coatesville, Pennsylvania, from 1982 to 1998. | |

| The Board of Directors has determined that Mr. van Roden is anaudit committee financial expert as that term is defined under the rules of the Securities and Exchange Commission. | ||

| Other Directorships: | Mr. van Roden is a director of Airgas, Inc., Penn Virginia GP Holdings, L.P. and Semco Energy Gas Company. In addition to H.B. Fuller, Mr. van Roden serves on the Audit Committees of both Airgas, Inc. and Penn Virginia GP Holdings, L.P. | |

| Michele Volpi | ||

| Age: | 42 | |

| Director Since: | 2006 | |

| Principal Occupation: | President and Chief Executive Officer, H.B. Fuller Company | |

| Business Experience: | Mr. Volpi was appointed President and Chief Executive Officer of H.B. Fuller Company in December 2006. He was Group President, General Manager of the Global Adhesives Division of H.B. Fuller Company from December 2004 to December 2006. Prior to that position, he served as Global Strategic Business Unit Manager, Assembly for H.B. Fuller Company from June 2002 to December 2004. From 1999 to June 2002, Mr. Volpi served as General Manager, Marketing for General Electric Company. | |

How can a Shareholder suggest a candidate for election to the Board?

The Corporate Governance and Nominating Committee of the Board nominates all candidates for election to the Board. Generally, current directors or management have identified candidates for consideration by the Committee. For this annual meeting, non-management directors identified all the nominees and no fees were paid to any third party with respect to the identification of any nominee for election at the meeting. If appropriate in the future, the Committee could engage a third person for a fee to assist in the process of identifying potential nominees. The Committee also will consider candidates put forward by any Shareholder. No Shareholder identified any candidate during fiscal year 2006. Any Shareholder interested in suggesting a candidate for election to the Board should contact the Corporate Governance and Nominating Committee through the Corporate Secretary.

The Committee assesses candidates to identify persons with the judgment, experience, independence and other attributes that the Committee concludes are pertinent in light of the Board’s current needs. The Board believes that its membership should reflect a diversity of experience, skills, geography, gender and ethnicity.

Who are the remaining directors?

The directors not standing for election at the meeting and whose service will continue until the end of their respective terms also provided the following information about themselves as of January 31, 2007.

Class I (Term Ending in 2009)

| Richard L. Marcantonio | ||

| Age: | ||

| Director Since: | 2004 | |

| Principal Occupation: | Chairman and Chief Executive Officer of G&K Services, Inc., a provider of uniform rental services, located in Minnetonka, MN. | |

| Business Experience: | Mr. Marcantonio has served as a director of G&K Services, Inc. since November 2003, and as Chairman and Chief Executive Officer since November 2005, prior to which he served as President and Chief Executive Officer from January 2004 to November 2005 and President and Chief Operating Officer from July 2002 to January 2004. From March 2002 until July 2002, Mr. Marcantonio served as President of the Industrial and Service Sectors at Ecolab, Inc., a leading global developer and marketer of cleaning and maintenance products. Mr. Marcantonio | |

| Other Directorships: | Mr. Marcantonio is a director of G&K Services, Inc. | |

| Alfredo L. Rovira | ||

| Age: | 61 | |

| Director Since: | 2003 | |

| Principal Occupation: | Managing partner of the law firm of Brons & Salas, and Co-Chairman of the Corporate Law Department of that firm, located in Buenos Aires, Argentina. | |

| Business Experience: | Mr. Rovira has been associated with Brons & Salas since 1970. At Brons & Salas, Mr. Rovira has had extensive experience as an arbitrator involving both domestic and multinational companies. He has also written and taught extensively on legal topics. | |

How can a Shareholder suggest a candidate for election to the Board?

The Corporate Governance and Nominating Committee ofAs mentioned above, Juliana L. Chugg will join the Board nominates all candidates for electionof Directors effective April 4, 2007. She is 39 years old. Ms. Chugg is Senior Vice President, President, Pillsbury USA of General Mills, Inc. Prior to the Board. Generally, current directors or management have identified candidates for consideration by the Committee. For this annual meeting, non-management directors identified all the nomineesthat, Ms. Chugg was Vice President, and no fees were paid to any third party with respect to the identificationPresident of any nominee for election at the meeting. If appropriateGeneral Mills’ Baking Products division. She also spent five years as Managing Director of International Operations in the future, the Committee could engage a third person for a fee to assistAustralia. In 1996, Ms. Chugg joined Pillsbury in the process of identifying potential nominees. The Committee also will consider candidates put forward by any Shareholder. No Shareholder identified any candidate during fiscal year 2005. Any Shareholder interested in suggesting a candidate for election to the Board should contact the Corporate Governance and Nominating Committee through the Corporate Secretary.Australia as Marketing Director.

The Committee assesses candidates to identify persons with the judgment, experience, independence and other attributes that the Committee concludes are pertinent in light of the Board’s current needs. The Board believes that its membership should reflect a diversity of experience, skills, geography, gender and ethnicity.

Who are the remaining directors?

The directors not standing for election at the meeting and whose service will continue until the end of their respective terms also provided the following information about themselves as of January 31, 2006.

Class II (Term Ending in 2007)

Class III (Term Ending in 2008)

| J. Michael Losh | ||

Age: | ||

Director Since: | 2001 | |

Principal Occupation: | Private Investor | |

| Business Experience: | Mr. Losh was the interim Chief Financial Officer of Cardinal Health, Inc., a provider of products and services for the health care market, located in Dublin, Ohio, from July 2004 to May 2005. He was the Chairman of Metaldyne Corporation, a global designer and supplier of high quality, metal-formed components, assemblies and modules for the transportation industry headquartered in Plymouth, Michigan, from 2000 to 2002. Prior to that position, Mr. Losh was employed by General Motors Corporation from 1964 to 2000. At General Motors he served in a variety of operating and financial posts in the U.S., Mexico and Brazil, including general manager of both the Pontiac and Oldsmobile divisions. From 1994 to 2000, Mr. Losh was Chief Financial Officer of General Motors. | |

| The Board of Directors has determined that Mr. Losh is anaudit committee financial expert as that term is defined under the rules of the Securities and Exchange Commission. | ||

| Other Directorships: | AON Corporation; AMB Property Corp.; Cardinal Health, Inc.; MASCO Corporation; Metaldyne Corporation; TRW Automotive Holdings Corporation.

In addition to H.B. Fuller, Mr. Losh serves on the audit committees of AMB Property Corp., Cardinal Health, Inc., MASCO Corp., Metaldyne Corp. and TRW Automotive Holdings Corp. The Board of Directors of H.B. Fuller has determined that such simultaneous service does not impair Mr. Losh’s ability to effectively serve on the Company’s Audit Committee. This determination reflects Mr. Losh’s experience and understanding of financial statements, accounting principles and controls and audit committee functions gained throughout his professional career, and his availability to devote time and attention to his service on each committee. | |

| Lee R. Mitau | ||

| Age: | ||

| Director Since: | 1996, Chairman of the Board since December 2006. | |

| Principal Occupation: | Executive Vice President and General Counsel, U.S. Bancorp, a bank holding company headquartered in Minneapolis, Minnesota. | |

| Business Experience: | Mr. Mitau has been Executive Vice President and General Counsel of U.S. Bancorp since 1995. | |

| Other Directorships: | Mr. Mitau is | |

| R. William Van Sant | ||

| Age: | ||

| Director Since: | 2001 | |

| Principal Occupation: | ||

| Business Experience: | Mr. Van Sant has served as President and Chief Executive Officer of Paladin from August 2006 to present. He served as Chairman at Paladin from July 2005 to | |

| Other Directorships: | Mr. Van Sant is a director of Graco Inc. | |

Does the Board have written corporate governance guidelines?

The Board, upon recommendation of the Corporate Governance and Nominating Committee, has adopted Corporate Governance Guidelines, thatwhich summarize many of the corporate governance principles whichthat the Board has followed in governing the Company. The guidelines are available for review atwww.hbfuller.com/InvestorRelations/Boardon the Investor Relations section of Directorsthe company’s website:www.hbfuller.com. A printed copy of the guidelines may also be obtained by sending a request to the Office of the Corporate Secretary, P.O. Box 64683, St. Paul, Minnesota 55164-0683.

Is a majority of the Board independent of management?independent?

Pursuant to our Corporate Governance Guidelines and the listing standards of the New York Stock Exchange, the Board has determined that all current members, other than Mr. Stroucken,Volpi, areindependent. No director is consideredindependent unless the Board affirmatively determines that such director has no material relationship with the Company. In assessing the materiality of any person’s relationship with H.B. Fuller, the Board considers all relevant facts and circumstances, including not only direct relationships between the Company and each director but also any relationships between H.B. Fuller and any entity with which a director is affiliated.

What is the Board’s policy with respect to attendance?

Directors are expected to attend the annual meeting of Shareholders and all meetings (including teleconference meetings) of the Board and each committee on which they serve. The Board, Compensation Committee and Corporate Governance and Nominating Committee each held five scheduled meetings during the 20052006 fiscal year. The Audit Committee held 2115 meetings during the 20052006 fiscal year, eleven6 of which were teleconference meetings. During the fiscal year, the directors attended 97%96% of the meetings of the Board and Board committees on which the directors served. In addition, sevenall of the then-serving directors attended the Company’s Annual Meeting of Shareholders held on April 14, 2005.6, 2006.

What are the roles of the Board’s committees?

The Board of Directors is responsible for the overall affairs of the Company. The Board conducts its business through meetings of the Board and three standing committees: Audit; Compensation; and Corporate Governance and Nominating. The Board has adopted a written charter for each committee. The Audit Committee charter is attached as Appendix A to this Proxy Statement. In addition, the charters for each of these committees are available for review atwww.hbfuller.com/on the Investor Relations/BoardRelations section of Directorsthe company’s website at:www.hbfuller.com. Printed copies of these charters may also be obtained by sending a request to the Office of the Corporate Secretary, P.O. Box 64683, St. Paul, Minnesota 55164-0683. When necessary, the Board also establishes ad hoc committees to address specific issues.

| Audit Committee | ||

| J. Michael Losh(Chair) | Alfredo L. Rovira | |

| Richard L. Marcantonio | John C. van Roden, Jr. | |

| Number of Meetings in fiscal year | ||

Functions: The Audit Committee appoints the independent auditors to audit the Company’s consolidated financial statements, oversees the audit and the independence and performance of independent public auditors, determines and pre-approves the type and scope of all audit, audit-related and non-audit services provided by our independent auditors, oversees our internal audit function, reviews the performance of our retirement plans and reviews the annual audited consolidated financial statements, accounting principles and practices and the adequacy of internal controls. This Committee also monitors compliance with our Code of Business Conduct.Conduct and our Policy and Procedures Regarding Transactions with Related Persons.

All of the members of the Audit Committee are considered independent as that term is defined by our Corporate Governance Guidelines, the listing standards of the New York Stock Exchange and applicable federal law and regulation. The Board of Directors has determined that Mr. J. Michael Losh and Mr. John C. van Roden, Jr. satisfy the requirements of anaudit committee financial expert as such term is defined under applicable federal law and regulation. The Audit Committee Report for fiscal year 20052006 is included in this Proxy Statement.

| Compensation Committee | ||

| R. William Van Sant(Chair) | Lee R. Mitau | |

| Knut Kleedehn | ||

Number of Meetings in fiscal year 20052006: Five

Functions: The Compensation Committee establishes overall compensation programs and practices for executives and directors, reviews and approves compensation, including salary, incentive

programs, stock-based awards, perquisites and supplemental benefits for executives who report to the Chief Executive Officer and the directors, and monitors the competitiveness, fairness and equity of our retirement plans. This Committee also has the authority to administer our stock-based compensation plans and individual awards.

All of the members of the Compensation Committee are consideredindependent as that term is defined by our Corporate Governance Guidelines and the listing standards of the New York Stock Exchange. The report of the Compensation Committee on Executive Compensation for fiscal year 20052006 is included in this Proxy Statement.

| Corporate Governance and Nominating Committee | ||

Lee R. Mitau(Chair) | R. William Van Sant | |

Knut Kleedehn | ||

Number of Meetings in fiscal year | ||

Functions: The Corporate Governance and Nominating Committee reviews matters of corporate governance, including reviewing our organizational structure and succession planning, and policies and practices relating to significant issues of corporate, social and public concern.planning. This Committee evaluates and recommends new director nominees and evaluates each current director prior to nominating such person for re-election. The Corporate Governance and Nominating Committee reviews a director’s continued service if a director’s occupation changes during his or her term. This Committee also evaluates the performance of the Chairman of the Board, the President and Chief Executive Officer, and the directors, and makes recommendations to the Board regarding any Shareholder proposals.

This Committee considers Shareholder recommendations for potential director nominees. Suggestions may be sent to the Corporate Governance and Nominating Committee in care of the Corporate Secretary of H.B. Fuller. See“How can a Shareholder suggest a candidate for election to the Board?”

All of the members of the Corporate Governance and Nominating Committee are consideredindependent as that term is defined by our Corporate Governance Guidelines and the listing standards of the New York Stock Exchange.

TheDuring fiscal year 2006, the Chair of the Corporate Governance and Nominating Committee actsacted as the Presiding Director of the Board. At each regularly scheduled meeting of the Board of Directors, the Presiding Director leadsled a discussion at which only independent directors are present. Lee R. Mitau was elected non-executive Chairman of the Board effective in December 2006, and in this capacity, will act as the Presiding Director at future Board of Director Meetings.

How are directors compensated?

The form and amount of compensation for each director is determined and reviewed at least annually by the Compensation Committee. Such compensation reflects the philosophy and practice for boards of similar public companies and is comprised of cash and H.B. Fuller Common Stock (or its equivalents). We have and maintain goals for stock ownership by all non-employee directors.

The following fees are paid to all directors who are not employees of the Company:

Annual Board retainer | $ | 32,000 | $ | 35,000 | ||

Annual retainer for non-executive Chairman of the Board | $ | 75,000 | ||||

Annual retainer for Audit Committee Chair | $ | 10,000 | $ | 10,000 | ||

Annual retainer for Compensation Committee Chair and Corporate Governance and Nominating Committee Chair | $ | 5,000 | $ | 7,500 | ||

Daily attendance fee for each Board meeting | $ | 1,000 | $ | 1,000 | ||

Attendance fee for each Committee meeting, either in person or via telephone | $ | 1,000 | $ | 1,000 | ||

Attendance fee for each Committee ad-hoc telephone meeting | $ | 500 | $ | 500 | ||

We also reimburse each director for any out-of-pocket expenses related to attendance at any meeting or arising from other Company business.

Mr. Stroucken, our President and Chief Executive Officer during fiscal year 2006, did not receive separate compensation for serving as Chairman of the Board of Directors nor for attendance at any

meeting. After the resignation of Mr. Stroucken, Mr. Mitau was elected non-executive Chairman of the Board of Directors. Mr. Mitau receives $75,000 per year to serve as non-executive Chairman of the Board. Mr. Volpi, as our current President and Chief Executive Officer, does not receive separate compensation for serving as Chairman of the Board of Directorsdirector nor for attendance at any meeting.

In addition to the retainer, meeting and attendance fees described above, the Board believes it is important that each director have an economic stake in our Common Stock. As a result, the Compensation Committee typically makes an annual grant of shares of restricted Common Stock or restricted Common Stock units to each non-employee director. During fiscal year 2005,2006, the Compensation Committee made a discretionary grant of 1,345946 H.B. Fuller Common Stock units to each non-employee director under the Directors’ Deferred Compensation Plan. Subsequent to this grant, these units were adjusted to reflect the two for one stock split that occurred in July, 2006. This plan is described below.

In addition, each director typically receives a one-time grant of H.B. Fuller Common Stock (or its equivalent) upon his/her initial election to the Board. During fiscal year 2005, Mr. Marcantonio received a grant of 1,300 shares of restricted Common Stock under the Directors’ Stock Incentive Plan. This plan is described below. These shares vest four years from the date of grant subject to continued service during that period.

Directors’ Deferred Compensation Plan. Under this plan, directors may elect to defer all or a percentage of their retainer, attendance or meeting fees. In addition, the Compensation Committee may make discretionary contributions to a participant’s Common Stock account under this plan. As described above, during fiscal year 2005,2006, the Committee exercised this discretion and granted each non-employee director 1,345946 H.B. Fuller Common Stock units under this plan. Subsequent to this grant, these units were adjusted to reflect the two for one stock split that occurred in July, 2006.

Deferred amounts are credited with gains and losses based on the performance of certain mutual funds or H.B. Fuller Common Stock as elected by the director prior to deferring any retainer or fees. Directors who elect their retainer, attendance or meeting fees to be deferred into H.B. Fuller Common Stock units as an investment are credited with phantom stock units that will be paid out in shares of Common Stock. Phantom stock units are credited with dividend equivalents equal to the amount of dividends, if any, paid on an equal number of shares of H.B. Fuller Common Stock. The dividend equivalents are converted into additional phantom stock units based on the fair market value of H.B. Fuller Common Stock on the dividend payment date. If a participant elects to defer retainer, attendance or meeting fees to the H.B. Fuller Common Stock account in this plan, we make a 10% matching contribution of additional phantom stock units to the amount invested in H.B. Fuller Common Stock by the director. The phantom stock units credited to the directors’ accounts do not have voting rights.

Any amounts deferred under this plan are paid in shares of H.B. Fuller Common Stock or cash at the earliest to occur of:

the last date on which the director serves as a director (that is, the date of resignation or removal from the Board or the end of the director’s elected term) or on the first, second, third, fourth or fifth anniversary of such date, as may be elected by the director in advance;

disability;

death; or

the date of a change in control of the Company.

Directors’ Stock Incentive Plan. Under this plan, we may issue to non-employee members of the Board of Directors restricted stock, restricted stock units, options, stock appreciation rights, performance awards or other stock-based awards. Shares of H.B. Fuller Common Stock are also

issued under this plan to satisfy any requirements under the Directors’ Deferred Compensation Plan. The Compensation Committee determines the type, amount and other terms and conditions of any award under this plan.

Physical Examinations. Non-employee directors are reimbursed for an annual physical examination. During the 20052006 fiscal year, we paid reimbursements totaling $19,566$22,407 for director physical examinations and related expenses.

Matching Gifts to Education Program. Under this program, we match a non-employee director’s contributions (up to $1,000) to eligible educational institutions. During the 20052006 fiscal year, we matched $1,000$3,000 of eligible contributions.

How can a Shareholder or other interested party contact the Board of Directors?

Any Shareholder or other interested party may contact the Board, any committee or an individual director, by mailing a letter addressed to the Board, committee or individual director in care of the Corporate Secretary. The Corporate Secretary reviews all communication, but will forward all such correspondence to the directors for their information and consideration.

Who is the Corporate Secretary?

The Corporate Secretary is Timothy J. Keenan. The mailing address is the Office of the Corporate Secretary, P.O. Box 64683, St. Paul, Minnesota 55164-0683.

PROPOSAL 2—APPROVAL OF AMENDED AND RESTATED YEAR 2000 STOCK INCENTIVE PLAN

PROPOSAL TO APPROVE THE AMENDED AND RESTATED H.B. FULLER COMPANY YEAR 2000 STOCK INCENTIVE PLAN

Our Board of Directors adopted, upon recommendation of the Compensation Committee, the H.B. Fuller Company Year 2000 Stock Incentive Plan (the “Current Stock Plan”), effective as of October 14, 1999. Adoption of the Current Stock Plan was subject to shareholder approval, which was obtained at the Annual Meeting of Shareholders held on April 20, 2000. Our Board of Directors adopted, upon the recommendation of the Compensation Committee, an amended and restated version of the Current Stock Plan (the “Amended and Restated Stock Plan”), effective as of January 27, 2006, subject to shareholder approval at the 2006 Annual Meeting of Shareholders.

The Amended and Restated Stock Plan:

No other material amendments were made to the Current Stock Plan in the Amended and Restated Stock Plan.

The Amended and Restated Stock Plan provides for the grant of stock-based awards to officers and key employees of the Company and its subsidiaries as determined by the Compensation Committee. The Amended and Restated Stock Plan has been designed to meet the requirements of Section 162(m) of the Internal Revenue Code regarding the deductibility of executive compensation.

The Board of Directors adopted the Amended and Restated Stock Plan in consideration of the limited number of shares remaining available for awards to officers and employees under the Current Stock Plan. As of January 31, 2006, only 525,535 shares remained available for awards under the Current Stock Plan. The Compensation Committee and the Board of Directors believe that the continued use of stock-based compensation in lieu of cash compensation is essential to implementing the Compensation Committee’s philosophy as described in the Compensation Committee Report on Executive Compensation in this Proxy Statement.

If the Amended and Restated Stock Plan is approved by shareholders, it will be effective as of January 27, 2006 and will supercede the Current Stock Plan. If the Amended and Restated Stock Plan is not approved by shareholders, it will not take effect or supercede the Current Stock Plan, and the Current Stock Plan will remain in full force and effect. The following summary of the Amended and Restated Stock Plan is qualified in its entirety by reference to the full text of the Amended and Restated Stock Plan, which is attached to this Proxy Statement as Appendix B.

Summary of the Amended and Restated Stock Plan

Purpose

The purpose of the Amended and Restated Stock Plan is to promote the interests of the Company and its shareholders by aiding us in attracting and retaining employees, officers, consultants and independent contractors capable of assuring our future success, to provide such persons with opportunities for stock ownership in the Company, and to offer such persons other incentives to put forth maximum efforts for the success of our business.

Administration

The Amended and Restated Stock Plan will be administered by the Compensation Committee of the Board of Directors (the “Committee”) comprised of at least the number of directors as is required to permit awards granted under the Amended and Restated Stock Plan to qualify under Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each member of the Committee will be a “non-employee director” within the meaning of Rule 16b-3 of the Exchange Act and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code. The Committee will have the authority to determine when and to whom awards will be granted, and to determine the form, amount and other terms and conditions of each award, consistent with the provisions of the Amended and Restated Stock Plan. Subject to the provisions of the Amended and Restated Stock Plan, the Committee may amend or waive the terms and conditions of an outstanding award but may not adjust or amend the exercise price of outstanding stock options or stock appreciation rights. The Committee will have full authority to interpret the Amended and Restated Stock Plan and establish rules and regulations for the administration of the Amended and Restated Stock Plan.

Eligibility

All employees, officers, consultants and independent contractors (other than non-employee directors) of the Company and its affiliates will be eligible to receive awards under the Amended and Restated Stock Plan at the discretion of the Committee. As of January 31, 2006, approximately 3,882 individuals were eligible to participate in the Amended and Restated Stock Plan.

Shares Authorized

The Amended and Restated Stock Plan provides for the issuance of up to 5,200,000 shares of our Common Stock, subject to adjustment in the event of a stock dividend or other distribution, recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase or exchange of Common Stock or other securities of the Company, issuance of warrants or other rights to purchase Common Stock or other securities of the Company or other similar changes in the corporate structure or stock of the Company. Of the 5,200,000 authorized shares, 3,000,000 shares were originally authorized under the Current Stock Plan. As of January 31, 2006, only 525,535 of the 3,000,000 shares remained available for issuance under the Current Stock Plan. The Amended and Restated Stock Plan will provide for an additional 2,200,000 authorized shares. Shares of our Common Stock subject to awards under the Amended and Restated Stock Plan that are not used or are forfeited because the terms and conditions of the awards are not met, or because the award terminates without delivery of any shares, may again be used for awards under the Amended and Restated Stock Plan. However, shares that are tendered by a participant or withheld by the Company as full or partial payment to the Company of the purchase or exercise price relating to an award or to satisfy tax withholding obligations relating to an award shall not be available for future grants under the Amended and Restated Stock Plan. In addition, if stock appreciation rights are settled in shares upon exercise, the aggregate number of shares subject to the award rather than the number of shares actually issued upon exercise shall be counted against the number of shares authorized under the Amended and Restated Stock Plan.

Of the 5,200,000 shares of our Common Stock authorized under the Amended and Restated Stock Plan, a maximum of 750,000 shares will be available for issuance pursuant to awards of restricted stock, restricted stock units, performance awards and other stock-based awards. As of January 31, 2006, 266,247 shares had been issued under the Current Stock Plan for such awards. Therefore, 483,753 shares will remain available for issuance under the Amended and Restated Stock Plan pursuant to awards of restricted stock, restricted stock units, performance awards and other stock-based awards. In addition, no participant may be granted stock options, stock appreciation rights or any other award, the value of which is based solely on an increase in the price of our Common Stock, for more than 300,000 shares in the aggregate in any calendar year. The closing price of our Common Stock as reported on the New York Stock Exchange on January 31, 2006 was $37.79.

Types and Terms of Awards

The types of awards that may be granted under the Amended and Restated Stock Plan are stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards, dividend equivalents and other stock-based awards. The term of each award may not be longer than 10 years from the date of grant. The Amended and Restated Stock Plan provides that all awards are to be evidenced by written agreements containing the terms and conditions of the awards. The Committee may not amend or discontinue any outstanding award without the consent of the holder of the award if such action would adversely affect the holder. Awards may be transferred only by will or by the laws of descent and distribution. During the lifetime of a participant, an award may be exercised only by the participant to whom such award is granted. However, the Committee may permit a participant to transfer certain stock options which may be exercised by someone other than the participant upon the death of the participant.

Stock Options. Incentive stock options meeting the requirements of Section 422 of the Internal Revenue Code and non-qualified stock options may be granted under the Amended and Restated Stock Plan. The Committee will determine the exercise price of any option granted under the Amended and Restated Stock Plan, but in no event will the exercise price be less than 100% of the fair market value of our Common Stock on the date of grant. Stock options may be exercised in whole or in part by payment in full of the exercise price in cash or such other form of consideration as the Committee may specify, including delivery of shares of Common Stock having a fair market value on the date of exercise equal to the exercise price. Stock options will be exercisable at such times as the Committee determines. Unlike the Current Stock Plan, the Amended and Restated Stock Plan does not provide for reload options.

Stock Appreciation Rights. The Committee may grant stock appreciation rights exercisable at such times and subject to such conditions or restrictions as the Committee may determine. Upon exercise of a stock appreciation right by a holder, the holder is entitled to receive the excess of the fair market value of one share of Common Stock on the date of exercise over the fair market value of one share of Common Stock on the date of grant. The payment may be made in cash or shares of Common Stock, or other form of payment, as determined by the Committee.

Restricted Stock and Restricted Stock Units. The Committee may grant shares of restricted stock and restricted stock units subject to such restrictions and terms and conditions as the Committee may impose. Shares of restricted stock granted under the Amended and Restated Stock Plan will be evidenced in book entry form or by stock certificates, which will be held by the Company, and the Committee may, in its discretion, grant voting and dividend rights with respect to such shares. No shares of stock will be issued at the time of award of restricted stock units. A restricted stock unit will have a value equal to the fair market value of one share of our Common Stock and may include, if so determined by the Committee, the value of any dividends or other rights or property received by shareholders after the date of grant of the restricted stock unit. The Committee has the right to waive any vesting requirements or to accelerate the vesting of restricted stock or restricted stock units.

Performance Awards. A performance award will entitle the holder to receive payments upon the achievement of specified performance goals. The Committee will establish the terms and conditions of a performance award, including the performance goals to be achieved during a performance period, the length of the performance period and the amount and form of payments of the performance award. A performance award may be denominated or payable in cash, shares of stock or other securities, or other awards of property.

Dividend Equivalents. An award of dividend equivalents will entitle the holder to receive payments equivalent to the amount of cash dividends paid by us to our shareholders with respect to a number of shares determined by the Committee. The Amended and Restated Stock Plan does not permit any dividend equivalent to be provided or granted with respect to any option or stock appreciation right awards. Dividend equivalents may be payable in cash, shares of stock or other securities, or other awards or property and will be subject to such terms and conditions as determined by the Committee.

Other Stock-Based Awards. The Committee may grant other awards denominated or payable in, valued by reference to, or otherwise based on or related to shares of Common Stock. The Committee will determine the terms and conditions of such award, including the consideration to be paid for shares of Common Stock or other securities delivered pursuant to a purchase right granted under such award. The Amended and Restated Stock Plan specifically authorizes the Committee to grant to eligible persons unrestricted shares, as deemed by the Committee to be consistent with the purpose of the Amended and Restated Stock Plan, including shares issuable pursuant to any of the Company’s other compensation or deferred compensation plans.

Termination and Amendment

The Amended and Restated Stock Plan permits the Board of Directors to amend or terminate the Amended and Restated Stock Plan at any time, except that prior shareholder approval will be required for any amendment to the Amended and Restated Stock Plan that (1) requires shareholder approval under the rules or regulations of the Securities and Exchange Commission, the New York Stock Exchange, any other securities exchange or the National Association of Securities Dealers, Inc., (2) permits repricing of outstanding stock options or stock appreciation rights granted under the Amended and Restated Stock Plan, (3) increases the number of shares authorized under the Amended and Restated Stock Plan, or (4) permits the award of stock options or stock appreciation rights under the Amended and Restated Stock Plan with an exercise price less than 100% of the fair market value of a share of Common Stock on the date of grant.

Effective Date; Term

If approved by shareholders, the Amended and Restated Stock Plan will be effective as of January 27, 2006 and will terminate on January 26, 2016. No awards may be granted under the Amended and Restated Stock Plan after January 26, 2016.

The following table sets forth the number of shares of our Common Stock covered by awards granted under the Current Stock Plan. No incentive awards made under the Amended and Restated Stock Plan prior to the date of the 2006 Annual Meeting of Shareholders have been made subject to shareholder approval. The numbers and types of awards that will be granted in the future under the Amended and Restated Stock Plan are not determinable as the Committee will make such determinations in its discretion. Generally, the consideration to be received by the Company for awards under the Amended and Restated Stock Plan will be the officers’ and employees’ past, present and expected future contributions to the Company.

Name and Position | Options Granted | Restricted Stock Granted | Restricted Stock Units | |||

Albert P.L. Stroucken Chairman of the Board, President and Chief Executive Officer | 536,170 | 65,196 | 0 | |||

John A. Feenan Senior Vice President, Chief Financial Officer | 84,251 | 15,105 | 0 | |||

Stephen J. Large Group President, General Manager, Full-Valu/Specialty Group | 100,792 | 16,444 | 0 | |||

Michele Volpi Group President, General Manager, Global Adhesives | 44,360 | 11,740 | 0 | |||

Jose Miguel Fuster Group Vice President, Latin America Region | 51,905 | 0 | 3,651 | |||

Executive Officer Group (10 persons, including the five above-named officers) | 951,899 | 132,961 | 3,651 | |||

Nonexecutive Director Group (7 persons) | 0 | 0 | 0 | |||

Nominees for Election as Director (0 persons) | 0 | 0 | 0 | |||

Each associate of the above-mentioned directors, executive officers or nominees | 0 | 0 | 0 | |||

Each other person who received or is to receive five percent of such options, warrants or rights | 0 | 0 | 0 | |||

Nonexecutive Officer Employee Group (339 persons) | 1,634,731 | 94,387 | 35,248 | |||

Equity Compensation Plans Information

Plan Category | (a) Number of | (b) Weighted-average | (c) Number of securities | |||||||

Equity compensation plans approved by security holders | 2,413,124 | (1) | $ | 26.87 | (2) | 823,464 | (3) | |||

Equity compensation plans not approved by security holders | NONE | — | NONE | |||||||

Total | 2,413,124 | $ | 26.87 | 823,464 | ||||||

|

|

| ||

| ||||

| ||||

| ||||

Grant of Options and Stock Appreciation Rights

The grant of a stock option or stock appreciation right is not expected to result in any taxable income for the recipient.

Exercise of Options and Stock Appreciation Rights

Upon exercising a non-qualified stock option, the optionee must recognize ordinary income equal to the excess of the fair market value of the shares of our Common Stock acquired on the date of exercise over the exercise price, and the Company will generally be entitled at that time to an income tax deduction for the same amount. The holder of an incentive stock option generally will have no

taxable income upon exercising the option (except that an alternative minimum tax liability may arise), and the Company will not be entitled to an income tax deduction. Upon exercising a stock appreciation right, the amount of any cash received and the fair market value on the exercise date of any shares of our Common Stock received are taxable to the recipient as ordinary income and generally deductible by the Company.

Disposition of Shares Acquired Upon Exercise of Options and Stock Appreciation Rights

The tax consequence upon a disposition of shares acquired through the exercise of an option or stock appreciation right will depend on how long the shares have been held and whether the shares were acquired by exercising an incentive stock option or by exercising a non-qualified stock option or stock appreciation right. Generally, there will be no tax consequence to the Company in connection with the disposition of shares acquired under an option or stock appreciation right, except that the Company may be entitled to an income tax deduction in the case of the disposition of shares acquired under an incentive stock option before the applicable incentive stock option holding periods set forth in the Internal Revenue Code have been satisfied.

Awards Other than Options and Stock Appreciation Rights

As to other awards granted under the Amended and Restated Stock Plan that are payable either in cash or shares of our Common Stock that are either transferable or not subject to substantial risk of forfeiture, the holder of the award must recognize ordinary income equal to (1) the amount of cash received or, as applicable, (2) the excess of (a) the fair market value of the shares received (determined as of the date of receipt) over (b) the amount (if any) paid for the shares by the holder of the award. The Company will generally be entitled at that time to an income tax deduction for the same amount.

As to an award that is payable in shares of our Common Stock that are restricted from transfer and subject to substantial risk of forfeiture, unless a special election is made by the holder of the award under the Internal Revenue Code, the holder must recognize ordinary income equal to the excess of (1) the fair market value of the shares received (determined as of the first time the shares become transferable or not subject to substantial risk of forfeiture, whichever occurs earlier) over (2) the amount (if any) paid for the shares by the holder of the award. The Company will generally be entitled at that time to an income tax deduction for the same amount.

Income Tax Deduction

Subject to the usual rules concerning reasonable compensation for U.S. employees, including the Company’s obligation to withhold or otherwise collect certain income and payroll taxes, and assuming that, as expected, stock options, stock appreciation rights and certain other performance awards paid under the Amended and Restated Stock Plan are “qualified performance-based compensation” within the meaning of Section 162(m) of the Internal Revenue Code, the Company will generally be entitled to a corresponding income tax deduction at the time a participant recognizes ordinary income from awards made under the Amended and Restated Stock Plan.

Application of Section 16

Special rules may apply to individuals subject to Section 16 of the Exchange Act. In particular, unless a special election is made pursuant to the Internal Revenue Code, shares received through the exercise of a stock option or stock appreciation right may be treated as restricted as to transferability and subject to a substantial risk of forfeiture for a period of up to six months after the date of exercise. Accordingly, the amount of any ordinary income recognized and the amount of the Company’s income tax deduction will be determined as of the end of that period.

Delivery of Shares for Tax Obligation

Under the Amended and Restated Stock Plan, the Committee may permit participants receiving or exercising awards, subject to the discretion of the Committee and upon such terms and conditions as it may impose, to deliver shares of our Common Stock (either shares received upon the receipt or exercise of the award or shares previously owned by the participant) to the Company to satisfy federal and state tax obligations.

Vote Required for Approval

We will vote your shares as you specify when providing your proxy. If you submit your proxy without voting instructions, we will vote your shares FOR the approval of the Amended and Restated Stock Plan.

The affirmative vote of a majority of the outstanding shares of Common Stock represented and entitled to vote on this matter is required to approve this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE APPROVAL OF THE AMENDEDAND RESTATED H.B. FULLER COMPANY YEAR 2000 STOCK INCENTIVE PLAN

PROPOSAL 3—RATIFICATION OF APPOINTMENT OF AUDITORS

Pursuant to its charter, the Audit Committee of the Board of Directors is responsible for the appointment, compensation and oversight of the work of the Company’s independent auditors. In the exercise of that authority, we, the members of the Audit Committee, determined to engage KPMG LLP to serve as the Company’s independent auditors for the year ending December 2, 2006.1, 2007.

The Audit Committee of the Board is composed solely of independent directors who satisfy all applicable requirements of federal law, the listing standards of the New York Stock Exchange and the Company’s Corporate Governance Guidelines. Except in our capacity as directors, no member of the Committee receives, directly or indirectly, any consulting, advisory or other compensatory fee from the Company, and no member is otherwise “affiliated” with the Company or any subsidiary, as such term is defined by applicable federal law and regulations. In addition to the foregoing, Mr. J. Michael Losh, Chair of the Committee and Mr. John C. van Roden, Jr., based upon their experience in the preparation and auditing of the financial statements of comparable companies and their understanding of generally accepted accounting principles, internal accounting controls and audit committee functions, are deemed to satisfy the requirements of anaudit committee financial expert as such term is defined under applicable federal law and regulation.

Management is responsible for the financial reporting process, accounting principles, and internal controls and procedures designed to assure compliance with accounting standards and applicable law and regulation. Management represented to us that H.B. Fuller’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

KPMG LLP, as H.B. Fuller’s independent auditors for fiscal year 2005,2006, was responsible for performing an independent audit of the consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report.

We have reviewed and discussed the audited consolidated financial statements with management and KPMG LLP. We have also discussed with KPMG LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees), and they have discussed with us their independence and provided to us the written disclosure required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

Based upon our discussions and our review of the representations of management and the report of the independent auditors, and in reliance upon such information, representations, reports and opinions, we recommended to the Board of Directors that the audited consolidated financial statements be included in H.B. Fuller’s Annual Report on Form 10-K for the fiscal year ended December 3, 20052, 2006 filed with the SEC.

J. Michael Losh(Chair) | ||||

Richard L. Marcantonio | Alfredo L. Rovira | John C. van Roden, Jr. | ||

Fees to the Independent AuditorAuditors

The following table presents fees for professional services provided by KPMG LLP for the audit, audit-related, tax and all other services rendered to us and our affiliates for the 20042005 and 20052006 fiscal years.

| 2005 | 2004 | 2006 | 2005 | |||||||||

Audit Fees | $ | 2,471,000 | $ | 1,991,000 | $ | 2,627,000 | $ | 2,471,000 | ||||

Audit-Related Fees | $ | 188,000 | $ | 330,000 | $ | 250,000 | $ | 188,000 | ||||

Tax Fees | $ | 46,000 | $ | 63,000 | $ | 4,000 | $ | 46,000 | ||||

All Other Fees | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||

Audit Fees: includes fees and expenses billed and to be billed for (i) the audit of the consolidated financial statements included in our annual report on Form 10-K, (ii) the audit of the effectiveness of our internal control over financial reporting, (iii) reviews of the interim consolidated financial information included in our quarterly reports on Form 10-Q, (iv) statutory audits of certain international subsidiaries, (v) consultations concerning financial accounting and reporting and (vi) reviews of documents filed with the Securities and Exchange Commission and consents.

Audit-Related Fees:Fees: includes fees and expenses for audits of employee benefit plans and due diligence services pertaining to potential business acquisitions.

Tax Fees: includes fees and expenses for international tax compliance and tax planning advice. For fiscal year 2004, we paid KPMG LLP $60,000 for tax compliance services and $3,000 for tax planning advice. For fiscal year 2005, we paid KPMG LLP $46,000 for tax compliance services. There were no fiscal year 2005 tax planning advice charges.

All Other Fees: includes fees and expenses associated with miscellaneous non-audit projects. There were no “All Other Fees” paid to KMPG LLP in fiscal years 20042005 and 2005.2006.

The Audit Committee has in place procedures to pre-approve all audit, audit-related, tax and other permissible services provided to us by our independent auditors. We have a policy of avoiding the engagement of our independent auditors except for audit, audit-related and tax compliance services. The Audit Committee has delegated to one or more of its members pre-approval authority with respect to permitted services, and receives a regular report from management on all such services provided to us by our independent auditors.

The Audit Committee has appointed KPMG LLP, certified public accountants, as our independent auditor for the fiscal year ending December 2, 2006,1, 2007, subject to Shareholder approval. KPMG LLP first

acted as our independent auditor during the fiscal year ended November 27, 2004. If the Shareholders, by an affirmative vote of a majority of our shares of Common Stock represented and entitled to vote at

the annual meeting, do not ratify the Audit Committee’s appointment of KPMG LLP as our independent auditor, the Audit Committee intends to reconsider that appointment. However, because of the difficulty and expense of making any change in independent auditors so long after the beginning of the current fiscal year, it is likely that the appointment would stand for fiscal year 20062007 unless there were compelling reasons for making an immediate change.

Representatives of KPMG LLP will be present at the meeting and will have the opportunity to make a statement if they desire to do so and to respond to appropriate questions from Shareholders.